Introduction

Most Singaporeans know how banks work—but credit co-ops? Not so much.

These community-based financial groups have quietly built up over $1 billion in assets, offering members attractive interest rates on savings and loans. But here’s the kicker: your deposits in a co-op aren’t protected by insurance like in a bank.

So the big question is: Are credit co-ops actually safe?

In this guide, we’ll explore how co-ops work, who oversees them, what happens if one collapses, and whether they deserve a place in your financial plan.

What Is a Credit Co-op and How Does It Work in Singapore?

Credit co-ops are like financial kampungs—small, member-owned communities that pool money to help each other.

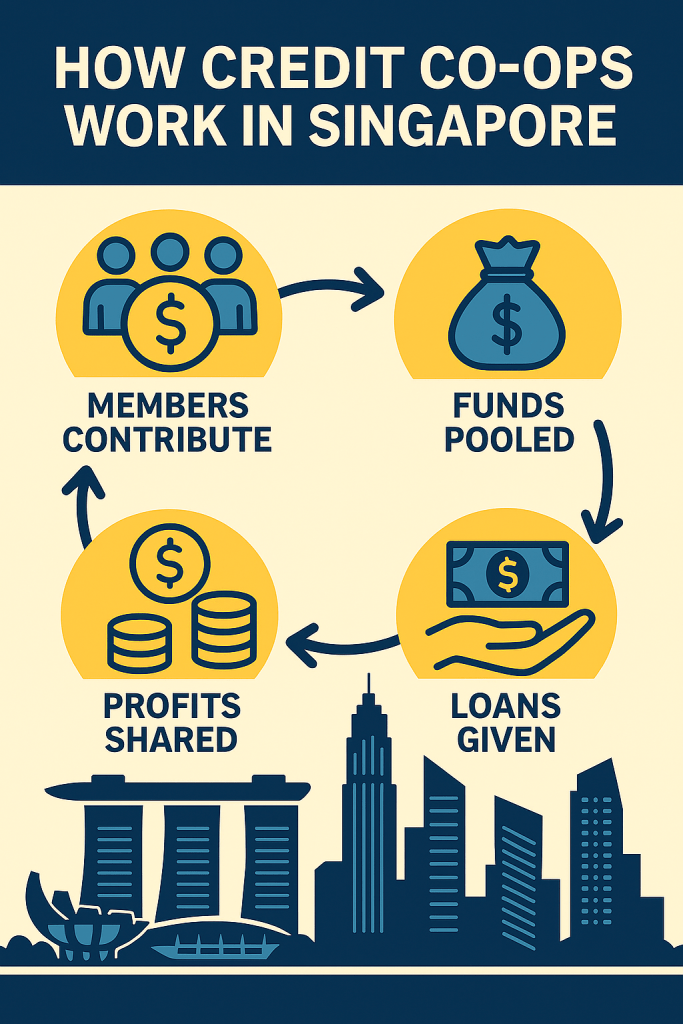

Each member:

- Contributes money regularly

- Can borrow at lower interest

- Earns returns (dividends) based on the co-op’s profits

They’re not-for-profit. So instead of enriching shareholders, the co-op returns excess earnings back to members.

Some well-known examples in Singapore include:

- TPGS Co-operative (teachers)

- Singapore Police Co-op

- NTUC Thrift & Loan

You usually need to be part of a specific profession or organization to join.

Are Credit Co-ops in Singapore Safe for Deposits?

This is the big one. The short answer: Yes—but with caveats.

Here’s why:

- They aren’t covered by SDIC, so your savings aren’t insured like with DBS or UOB.

- However, they’re still legally regulated under the Co-operative Societies Act, overseen by the Registry of Co-operative Societies under MCCY.

- Co-ops must:

- Submit annual audited financials

- Comply with capital adequacy and liquidity rules

- Limit how much any single member can deposit or borrow

So while they don’t offer the same protection as banks, there are built-in risk controls.

Pro Tip: Look for a Type 2 co-op (those that take deposits) and make sure they’re affiliated with SNCF for added credibility.

How Are Credit Co-ops Regulated and Monitored?

Singapore’s credit co-ops aren’t left alone to run wild.

They’re governed under the Co-operative Societies Act and regulated by the Registry of Co-operative Societies, part of MCCY. This isn’t MAS—but the standards are still serious.

Credit co-ops are divided into:

- Type 1: Provide only loans from subscribed savings

- Type 2: Accept deposits and fixed savings plans (stricter rules)

Each co-op must:

- Cap total deposits at no more than 10x their capital

- Perform regular financial audits

- Abide by internal governance standards (like proper board oversight)

And while co-ops don’t pay license fees like banks, they’re still under government scrutiny. In short: regulated, but not insured.

What Happens If a Co-op Fails?

It’s rare, but not impossible.

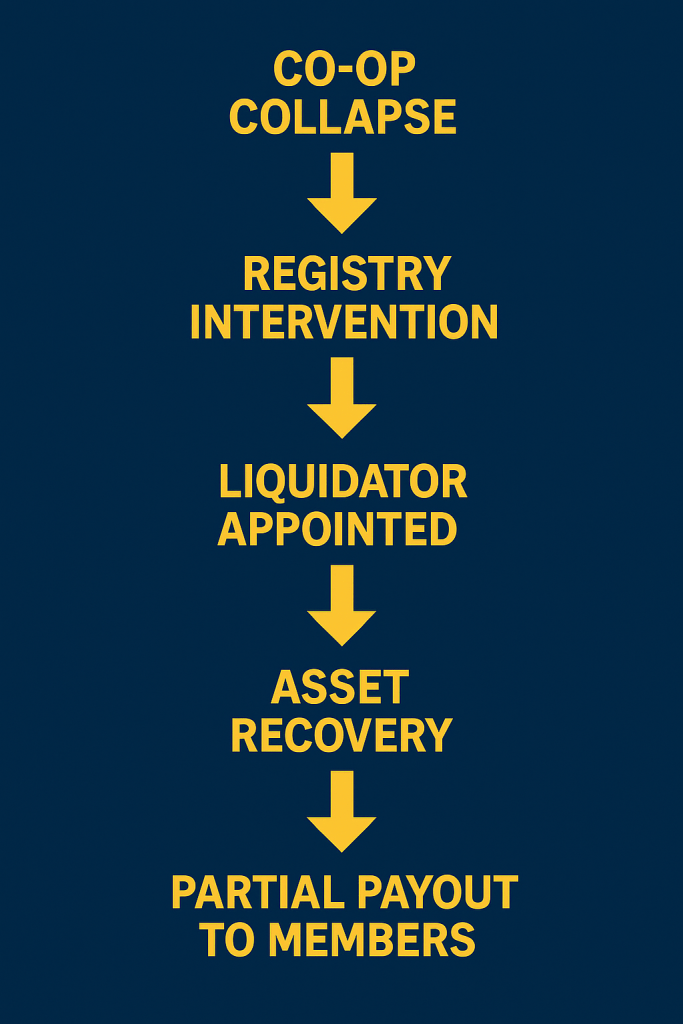

If a credit co-op fails:

- It can be deregistered by the Registry.

- A liquidator is appointed to sell its assets.

- Members may get back some of their money—but not all.

Because co-op members are also shareholders, they absorb the risk, just like investors in a company.

There’s no MAS bailout. No SDIC safety net. That’s why it’s important to:

- Choose well-established co-ops

- Understand the co-op’s balance sheet

- Avoid putting all your emergency funds into one

The good news? Failures are extremely rare in Singapore due to tight controls.

Should You Save Your Money in a Credit Co-op?

It depends on your goals.

Good for you if:

✅ You’re looking for better-than-bank interest

✅ You’re eligible to join (by profession or union)

✅ You want to support community-based finance

✅ You don’t mind doing basic due diligence

Not ideal if:

❌ You need instant liquidity

❌ You can’t stomach the idea of no deposit insurance

❌ You don’t qualify for membership

Tip: Start small. Look for co-ops offering salary deduction plans or monthly savings schemes, then review performance yearly.

Conclusion

Credit co-ops in Singapore can be a safe and smart place to save—if you understand the trade-offs.

They aren’t insured like banks, but they are heavily regulated and community-driven. For many, the higher returns and shared values make up for the added risk.

Leave a comment