Introduction

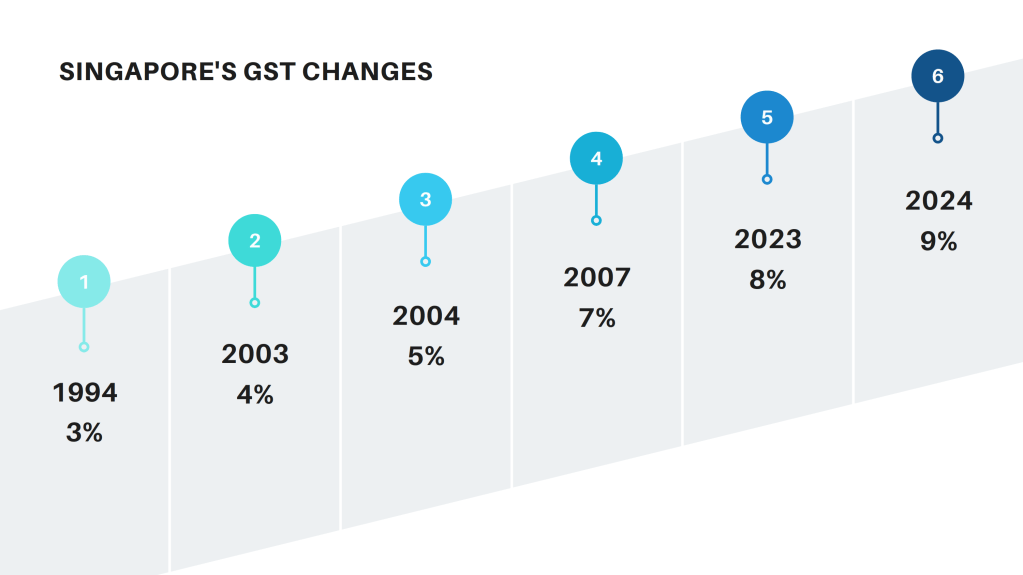

Goods and Services Tax (GST) has played a vital role in Singapore’s fiscal strategy since its introduction at 3% on 1 April 1994. Over three decades, GST was gradually raised—4% in 2003, 5% in 2004, and 7% in 2007—to broaden Singapore’s revenue base and fund rising social expenditure. The most recent hikes raised GST to 8% in 2023 and 9% in 2024, mainly to support healthcare, eldercare, and infrastructure for an ageing population.

At GE2025, GST policy has become a defining election issue. This guide examines the proposals of PAP, WP, and PSP to help you understand their fiscal impacts and implications for voters.

Singapore’s GST Timeline

- 1994: GST introduced at 3% with offsetting income tax cuts.

- 2003–2004: Raised to 5% following the Economic Review Committee’s recommendations.

- 2007: Raised to 7% alongside a $3 billion offset package.

- 2023–2024: Raised to 9% with over $10 billion in Assurance Package support.

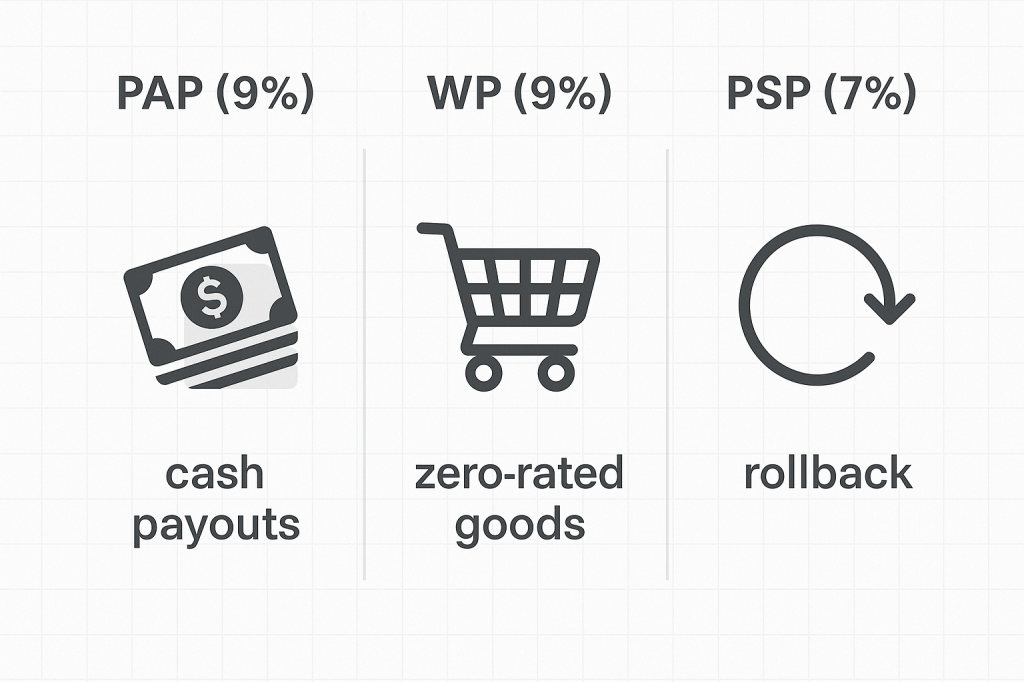

PAP’s GST Approach

The People’s Action Party (PAP) intends to maintain GST at 9%, emphasizing that steady revenues are crucial to fund future healthcare, eldercare, infrastructure, and climate initiatives. Rather than cutting the GST rate, PAP focuses on targeted assistance:

- Cash Payouts: $300–$600 for adults, up to $900 for seniors.

- CDC Vouchers: $100–$300 to offset daily expenses.

- U-Save Rebates: Up to $950 per year for utilities bills.

These measures are part of the Assurance Package, totaling about $10 billion to cushion GST’s impact.

WP’s GST Proposal

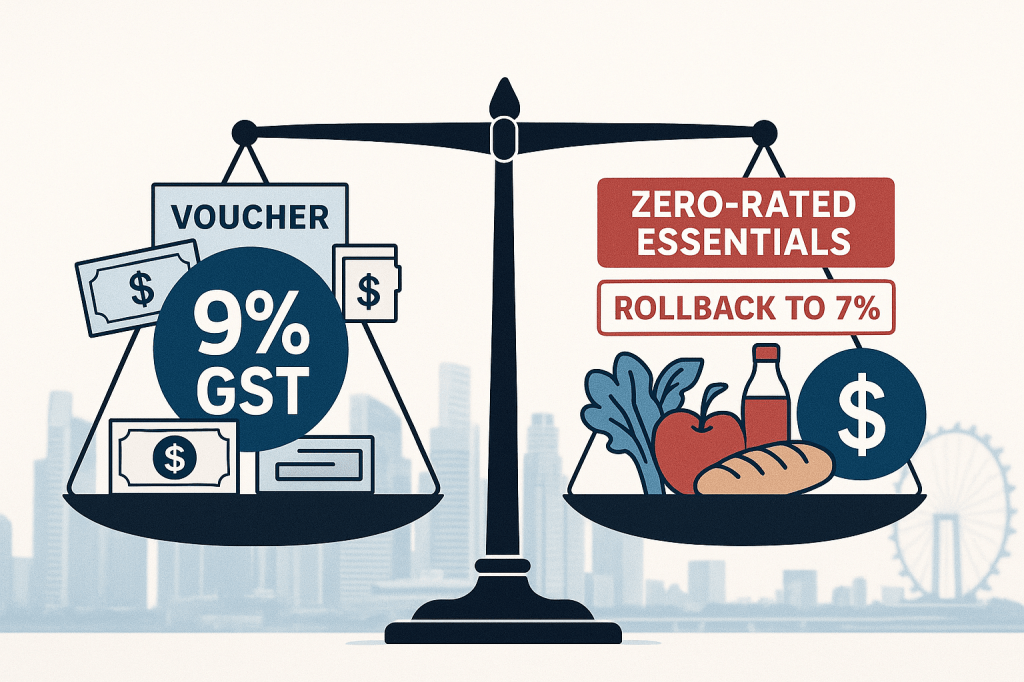

The Workers’ Party (WP) proposes maintaining the 9% GST but exempting essential goods and services from GST:

- Basic food items (e.g., rice, cooking oil).

- Utilities like water and electricity.

- Public transportation and educational materials.

To offset the lost GST revenue, WP proposes:

- Introducing a net wealth tax of 0.5–2% on the top 1% of wealth holders.

- Implementing a 15% minimum effective corporate tax rate under global OECD BEPS initiatives.

- Recognizing proceeds from land sales (leases under 10 years) as operating revenue, as already done under certain government accounting practices.

WP argues this would be broadly revenue-neutral while making GST less regressive.

PSP’s GST Proposal

The Progress Singapore Party (PSP) proposes rolling back the GST rate from 9% to 7% and zero-rating basic necessities, including:

- Rice, eggs, cooking oil, wheat flour, formula milk.

- Drinking water.

PSP plans to offset the estimated $2.1 billion revenue loss mainly through drawing a small, recurring portion of investment returns from Singapore’s substantial national reserves (about $1.22 trillion), while maintaining the long-term growth of reserves.

Comparative Summary

| Party | GST Rate | Key Relief Measures | Estimated Annual Impact |

|---|---|---|---|

| PAP | 9% | Cash payouts, CDC vouchers, U-Save rebates | $10 billion (Assurance Package) |

| WP | 9% | Zero-rating essentials, funded by wealth and corporate taxes | Approximately revenue-neutral (~$2.5 billion offset) |

| PSP | 7% | Rate rollback + zero-rating essentials | $2.1 billion annual revenue shortfall |

Methodology & Assumptions

- PAP: $10 billion figure is based on the total Assurance Package size cited in Budget 2024 speeches and reports.

- WP: Based on Workers’ Party 2025 Manifesto, which proposes zero-rating essentials. Estimated impact (~$2.5 billion) inferred from GST collected on basic essentials, offset by proposed wealth tax, corporate tax minimums, and land revenue reclassification. (WP Manifesto, 2025)

- PSP: Based on PSP Manifesto which estimates a rollback from 9% to 7% costing approximately $2.1 billion annually, funded partially from NIRC. (PSP Manifesto, 2025)

Conclusion

The GST debate at GE2025 is about more than just rates—it reflects competing visions for Singapore’s social compact. Will voters prioritize sustained social spending with targeted relief (PAP), structural reform to ease essentials (WP), or a rollback and reduction of broad tax burdens (PSP)?

Study the facts, weigh the trade-offs, and vote informed in GE2025.

Links to Full Party Manifestos:

Leave a comment